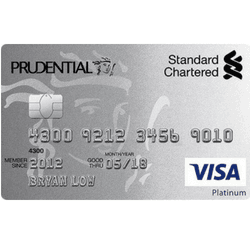

Standard Chartered Bank Platinum Credit Card Limit

Is there a cash withdrawal limit on my credit card.

Standard chartered bank platinum credit card limit. Earn up to 300 additional rewards points per month on your other banking relationships in deposits mortgages investments and online transactions when you charge 250 to your platinum credit card in that calendar month. You can earn reward points across all spending categories and enjoy cashback on your supermarket spends. With standard chartered business visa platinum you can enjoy a credit limit of up to rm 300000 to fulfil your business requirements.

Where can i use standard chartered visa platinum credit card. For example if your credit limit is pkr 100 000 and your withdrawal limit is 30 then your cash withdrawal limit will be pkr 30 000. Standard chartered manhattan platinum credit card is one of the most suitable cards for lifestyle expenditure.

However for all visa infinite and emirates world credit cards the monthly interest rate is 3 10 pm apr of 37 20. Click here to register for online banking or sc mobile. The standard chartered visa platinum credit card can be used at a vast range of merchant outlets that accept visa credit cards all over the world.

High credit limit liquidity is not only crucial for the survival of a business but also to facilitate future expansion. You can avail credit card loans up to inr 5 00 000 with a flexible repayment period ranging from 12 months to 60 months. Standard chartered platinum rewards credit card rewards its users for shopping and lifestyle expenses.

Dial a loan this is an exclusive feature for all standard chartered platinum rewards credit card users. Credit usage and repayment pattern indicate the creditworthiness of the applicant. Go to card details on the top right section and view the credit limit assigned on your credit card.

You can withdraw up to 30 of your credit limit in cash. Below mentioned is the primary factors that decide the standard chartered bank credit card limit. Monthly interest rate of 3 49 pm is annualized to arrive at an apr of 41 88 for all standard chartered credit cards.

Platinum visa mastercard credit card xtrasaver current account. Accumulated reward points can be used to get vouchers and merchandise or to pay off the credit card bills. Timely payment of loans and managing the debts well create a good credit history.

To enjoy more benefits sign up for our personal banking suite.